So, you’ve hit the jackpot. The numbers finally aligned, and your life has just been catapulted into a new, dizzying reality. The initial shock and euphoria are, honestly, like nothing else. But as the confetti settles, a more complex picture comes into focus. Suddenly, you’re not just a person—you’re a public event. And the people closest to you, your family, are now navigating this strange new landscape right alongside you.

Let’s be real. A sudden windfall doesn’t just change your bank balance; it acts like a highlighter pen over every existing family dynamic. Old tensions, unspoken expectations, and deep-seated loyalties are all suddenly illuminated. The challenge? Managing family relationships after winning the lottery while trying to hold onto some shred of the private life you once knew. It’s a tightrope walk, for sure. But it’s one you can manage with intention, a lot of heart, and some tough conversations.

The Immediate Aftermath: When News Breaks

In many places, big lottery wins are public record. Your name, your town—it’s out there. That moment changes everything. Your phone might start ringing with numbers you don’t recognize. Distant relatives you haven’t spoken to in a decade might suddenly remember your birthday. It’s overwhelming.

The first, and perhaps most crucial, step is to pause. Do not make any big promises. Do not feel pressured to solve anyone’s problems in the first 48 hours. Your job is to breathe and get your own bearings. A common piece of advice from financial advisors who’ve seen this before? Go dark for a bit. Turn off the notifications, let calls go to voicemail, and give yourself space to think.

The Family Conversation: Setting Boundaries is an Act of Love

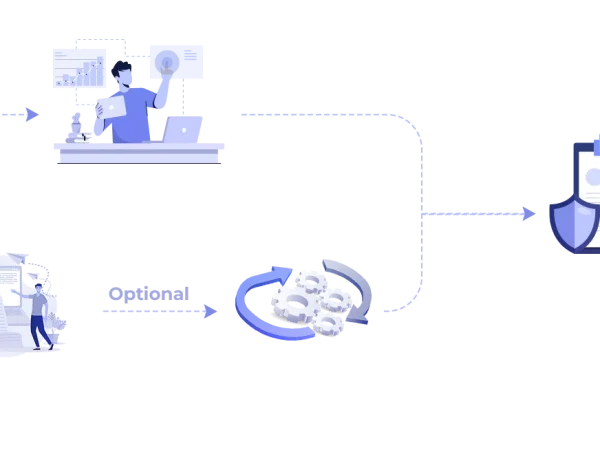

Okay, you’ve had a minute. Now comes the hard part: talking to your inner circle. This isn’t about dictating terms; it’s about establishing a new framework for your relationships. Think of it like installing a new security system in a home you all share—it’s for everyone’s protection.

Key Topics to Address (Sooner Rather Than Later)

- Privacy & The “Information Diet”: Decide, as a family unit, what you will and won’t share publicly. Who needs to know the exact amount? Probably no one outside the immediate family. Agree that specific financial details stay within a tight, trusted group. This is your first line of defense against the outside world.

- The “Ask” Protocol: Money requests can poison relationships fast. Establish a clear, non-confrontational way for family to bring up financial needs. Maybe it’s a scheduled conversation, or a rule that all requests go in writing first. This isn’t cold—it’s professional, and it removes the emotional heat from spontaneous, awkward asks.

- Unified Front Against External Pressure: You’ll get sob stories, investment “opportunities,” and charitable pleas. Agree as a family to have a standard response. “We’re working with a team to get our affairs in order and aren’t making any decisions right now,” is a perfect, polite shield.

The Emotional Quicksand: Jealousy, Guilt, and Changed Roles

This is where it gets psychologically tricky. You might feel immense guilt for your good fortune, especially if family members are struggling. A sibling might feel jealous, even if they’re happy for you. The family peacekeeper might suddenly become the family bank. These shifts are subtle, but they’re real.

Be prepared for role confusion. The younger sister who always looked up to you might now see you as a resource first. The older brother who offered advice might feel his role is diminished. Acknowledge these feelings—in yourself and others. Sometimes, just saying, “This is weird for me too,” can open up an honest dialogue. The goal isn’t to prevent every negative emotion; it’s to navigate them without letting them define your relationships.

Practical Steps: Building Your Financial & Emotional Infrastructure

You can’t wing this. Protecting your family and your privacy after a windfall requires a system. Here’s a basic framework to consider.

| Step | Action | Why It Helps Family Dynamics |

| 1. Assemble Your Team | Hire a fee-based financial advisor, an estate lawyer, and a CPA—before you claim. | Creates objective, third-party authority. “The advisor recommends we wait” is easier than “I don’t want to give you money.” |

| 2. The “Gift” Policy | Decide, with your advisor, if you’ll give gifts. Set a annual limit and stick to it. Treat it like a budget line item. | Prevents favoritism, manages expectations, and ensures your own long-term security isn’t jeopardized. |

| 3. Estate Planning Update | Immediately update wills, trusts, and beneficiaries with your lawyer. | Prevents future family conflict and ensures your wishes are clear, which is a profound act of care. |

| 4. Digital Privacy Lockdown | Change phone numbers, use a PO Box, tighten social media privacy, consider a trust to claim anonymously if possible. | Protects your entire family from scams and intrusive contacts, reducing stress for everyone. |

Honestly, that last point about claiming anonymously is huge. If your state allows it, using a trust or LLC to claim the prize is the single most effective privacy shield. It lets you control the narrative, or avoid having one at all.

When Saying “No” is the Most Loving Thing You Can Do

This might be the hardest skill to learn. A request comes in—a business idea, a debt payoff, a dream vacation. It feels personal. But you have to separate the person from the request. Is it a one-time need or a recurring ask? Does it align with the financial plan you built with your advisor?

Saying “no” doesn’t mean you don’t love them. In fact, an endless “yes” can be more damaging. It can create dependency, resentment, and a dynamic where people are connected to you only by a financial thread. A clear, kind “no,” perhaps paired with a smaller, symbolic gesture of support, often preserves the relationship far better than a resentful “yes.”

The Long Game: Redefining Normal

After a year or two, a new normal will emerge. The frantic calls will slow. The family will have adjusted to the new boundaries—or they won’t have, and you’ll have learned who you can truly count on. And that’s a painful but vital revelation.

The real win isn’t the money. It’s preserving the relationships that matter. It’s creating a life where your family gatherings are about shared memories, not shared finances. It’s about using your security to create a buffer against the world for those you love, without letting that buffer become a wall between you.

In the end, navigating this journey is about protecting not just your privacy, but your humanity. And the humanity of your family. The money is a tool. The family is the foundation. Don’t let the tool damage the foundation. Build with care.